The reported volumes for cryptocurrencies are extremely misleading. Furthermore, although there is only one category called volume, blockchain explorers will refer to a data point that is much different than what is reported by cryptocurrency exchanges. In this article, we’ll take a closer look at Bitcoin volumes and what they actually mean.

Blockchain Volumes

Any blockchain explorer will show general details regarding the current state of the blockchain. There are several explorers available for Bitcoin. For example, take this one at Blockchair.com. In the top section, there is a central column entitled, “24h stats.” Within that column there is a data point called On-chain volume. That a pretty good name for it because it does indeed report the total amount of Bitcoin that has been processed on the blockchain over the last 24 hours. However, this will be misleading if one expects this to coincide with the amount of Bitcoin that was actually transferred from one entity to another.

One must remember that blocks on the blockchain are a collection of transactions. Each transaction contains inputs & outputs. The inputs are the spenders and the outputs are receivers. If Mike needs to send 2 bitcoins to Sally then Mike will need to create a transaction with one or more inputs that amount to 2 bitcoins. The following scenarios are possible:

– If Mike has one wallet address with 3 bitcoins, he can send those 3 bitcoins as an input. This will result in an output of 2 bitcoins to Sally, and another output of 1 bitcoin back to Mike as change. In this case, the blockchain will include the entire 3 bitcoins within the On-chain volume statistic.

– If Mike has 2 wallet addresses, one with 1 bitcoin and the other with 1.5 bitcoin, then he can send both as inputs. This will result in an output of 2 bitcoins to Sally, and another output of 0.5 bitcoins as change back to Mike. In this scenario, the On-chain volume will include the entire 2.5 bitcoins.

Unless Mike has an address with exactly 2 bitcoins, he will always get change back (disregarding fees to keep it simple). This is because the entire amount of an address’ contents must always be sent for a transaction input. If Mike were allowed to split an address’ contents and only send part of it as an input, it would mean that address had undergone an off-chain transaction, which would not be verifiable on the blockchain, thus negating the whole blockchain concept.

In both of these cases the blockchain’s On-chain volume is accurately presented as the actual amount of Bitcoin processed by the system. But is this really the volume we’re interested in seeing? Or are we more interested in the number of transfers between different entities? In other words, wouldn’t we rather see the TRUE volume of 2 bitcoins, which was the actual number of bitcoins that were transferred between Mike and Sally?

It is possible to get this information – straight from the blockchain itself. Why the popular explorers don’t report this is unknown, because the calculations are not difficult. Simply parse the transactions within each block and add up the output addresses that are not simultaneously listed as an input.

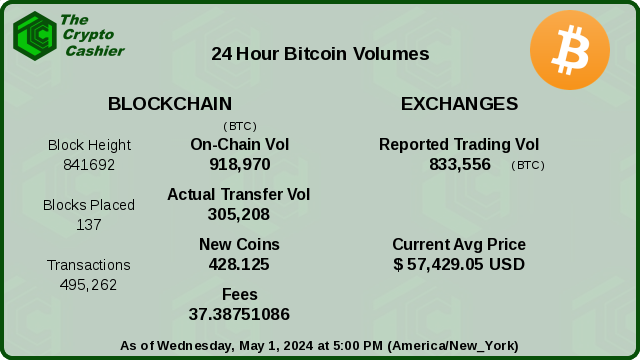

In fact, the difference between the On-chain volume and the volume of actual transfers can be quite startling. Of course, it varies from block to block, but the true transfer volume is frequently a small fraction of the On-chain volume. For example, at the time of this article’s writing, the Bitcoin blockchain had just placed block #601608. Over the previous 24 hour period the blockchain had produced 125 blocks containing a total of 303,412 transactions. The On-chain volume of all those transactions was 1,749,954 bitcoins. However, the true transfer volume was only 485,422 bitcoins.* This means that 72% of the On-chain volume was mere change – bitcoins going back to the original senders’ addresses.

Exchange Volumes

One reason some people believe that cryptocurrencies will return our economic system back to one based on sound money concepts, is because they understand that the blockchain prohibits the printing of money, as our central bank does on a regular basis today. They also understand that one must first have a Bitcoin in order to sell a Bitcoin. Unfortunately, this is not the case. Bitcoin has been commoditized, much like gold, silver, oil & soybeans.

Let’s verify this by looking at the volumes being reported by the cryptocurrency exchanges. Over at Coinmarketcap.com, one can easily see the market volume for Bitcoin over the past 24 hours. By default, the Chart tab is active, but if the Market tab is clicked, then a list of market activity is shown, with the top volume producers shown at the top. (And note that this page gives some meaning to their methods.) Again, by default the volumes are shown in USD. But the drop-down selector on the right allows the volume to be changed to show BTC, which will show the amount of Bitcoin traded within the last 24 hours for each of the exchanges listed.

Also shown is the percentage of the total exchange volume that each specific exchange represents. So, just given one of the volume specifications allows us to calculate the total exchange volume (the amount of Bitcoin that has been traded within all of the exchanges which Coinmarketcap.com tracks). For instance, at the same time the snapshot was taken in the example in the previous section (at block #601608), the exchange BKEX had the most volume of Bitcoin trades, which was 99,433 BTC. It also specified that reflected 3.33% of the total exchange volume. From that, we can calculate the combined total Bitcoin traded among all exchanges, which is 2,985,976 BTC. That’s extremely revealing!

During the same 24 hour period, the blockchain had the following volumes:

– True transfer volume: 485,422 BTC

– Total On-chain volume: 1,749,954 BTC

But all the exchanges report trading 2,985,976 BTC during that period. How could this be?

One possible explanation is that the exchanges are reporting volumes that are higher than their actual values in order to improve their ranking, and thus public perception of their platform. While this is probably true for some of the more nefarious exchanges, there is another explanation that warrants further study.

Anyone who has traded cryptocurrencies knows that trades happen rather quickly, as they do in most markets. If each trade had to wait to be included and confirmed in block hashes, the market would be extremely inefficient. The Bitcoin blockchain produces a new block roughly every 10 minutes, give or take. And each block only contains about 2500 transactions. So actually, it makes sense that exchanges would not use actual bitcoins when executing trades. For the purpose of providing responsive and efficient cryptocurrency markets, exchanges would need to use some kind of synthetic credit system where credits represent the underlying cryptocurrency instead of being the actual cryptocurrency.**

So the exchanges are not trading actual bitcoins. Instead, they are offering a synthetic representation of bitcoins in order to establish an efficient market for buy/sell orders and expedient confirmations. Much like the fractional reserve policies employed by our banking institutions, the exchanges only need to deliver authentic bitcoins when their customers want to withdraw their bitcoins and keep them in their own wallets. If people (or corporate entities) are happy to keep their pool of synthetic BTC at the exchange, there won’t be any trouble. But if all the accounts suddenly asked for their Bitcoin, it would be similar to a bank-run – the exchange would have to shut down, at least temporarily.

But there’s even worse news. If the exchanges are not using authentic bitcoins for trades, the market can be driven up and down, depending on which entities hold the most synthetic bitcoins. After all, these are just digital representations on some electronic spreadsheet. Combined with the newly developed crypto-derivative products in the futures markets, fortunes can be made by manipulating the underlying price. It’s similar to the commodity markets where the underlying commodity has very little to do with price discovery. Instead, paper contracts are thrown into the markets in order to drive the price in the desired direction.

Under this scenario, the belief that one must have a Bitcoin in order to sell a Bitcoin is simply not true.

*The transfer volume is probably even lower than this because some wallets frequently create transactions which specify a separate address to receive the change. So in those cases, even though the input & output addresses may be unique, they belong to the same entity.

**This can also be shown to be the case with cryptocurrencies which do not support decimals – even though fractional amounts are not supported on their respective blockchains, those same cryptos are traded in fractional amounts on exchanges. This reveals that those exchanges cannot possibly be trading the actual cryptocurrency, but instead are using an arbitrary representation of the cryptocurrency.

Recent BTC Volume Snapshot

Is this the same as “open interest”?

https://www.investopedia.com/terms/o/openinterest.asp

Busy just now but would like to take a closer look later.

Not really. The on-chain volumes specify the amount of BTC that have been handled by the blockchain and the reported exchange volumes show the total amount of BTC that was traded between buyers and sellers on those exchanges. Open interest is usually a only valid data point for contracts in the options and futures markets. For those markets, as your link suggests, the open interest shows the current number of outstanding contracts that have not yet been settled.